Even perpetual inventory users may wish to perform a physical inventory count from time to time to allow for shrinkage (theft, broken, and obsolete items). Small business owners’ activities are often restricted to the cash register and fairly straightforward accounting procedures. Therefore, small business owners would benefit most from the periodic inventory system. You wouldn’t need an inventory management system for companies that only supply services rather than items. This is, of course, unless you are in the hospitality sector, running a restaurant, or you have inventory products that need to be tracked, such as food or medications.

Less Control and Information

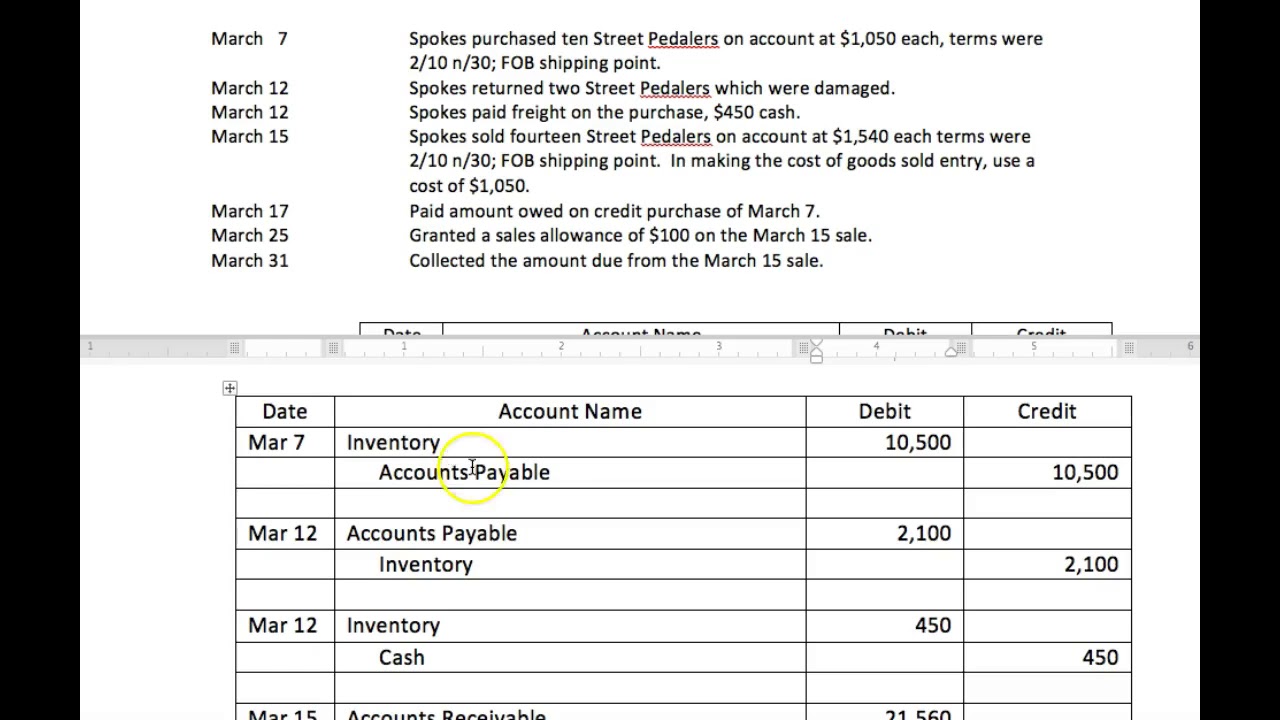

In a periodic inventory system, the physical count of the inventory is done on a monthly, quarterly or annual basis. This allows the business to identify discrepancies between the physical count and the book count of the inventory, which can be used to identify any problems in the inventory management process. The example below shows the journal entries necessary to record inventories under the periodic system. The information from the example data illustrates the perpetual inventory method.

Cost Flow Assumption Diagram

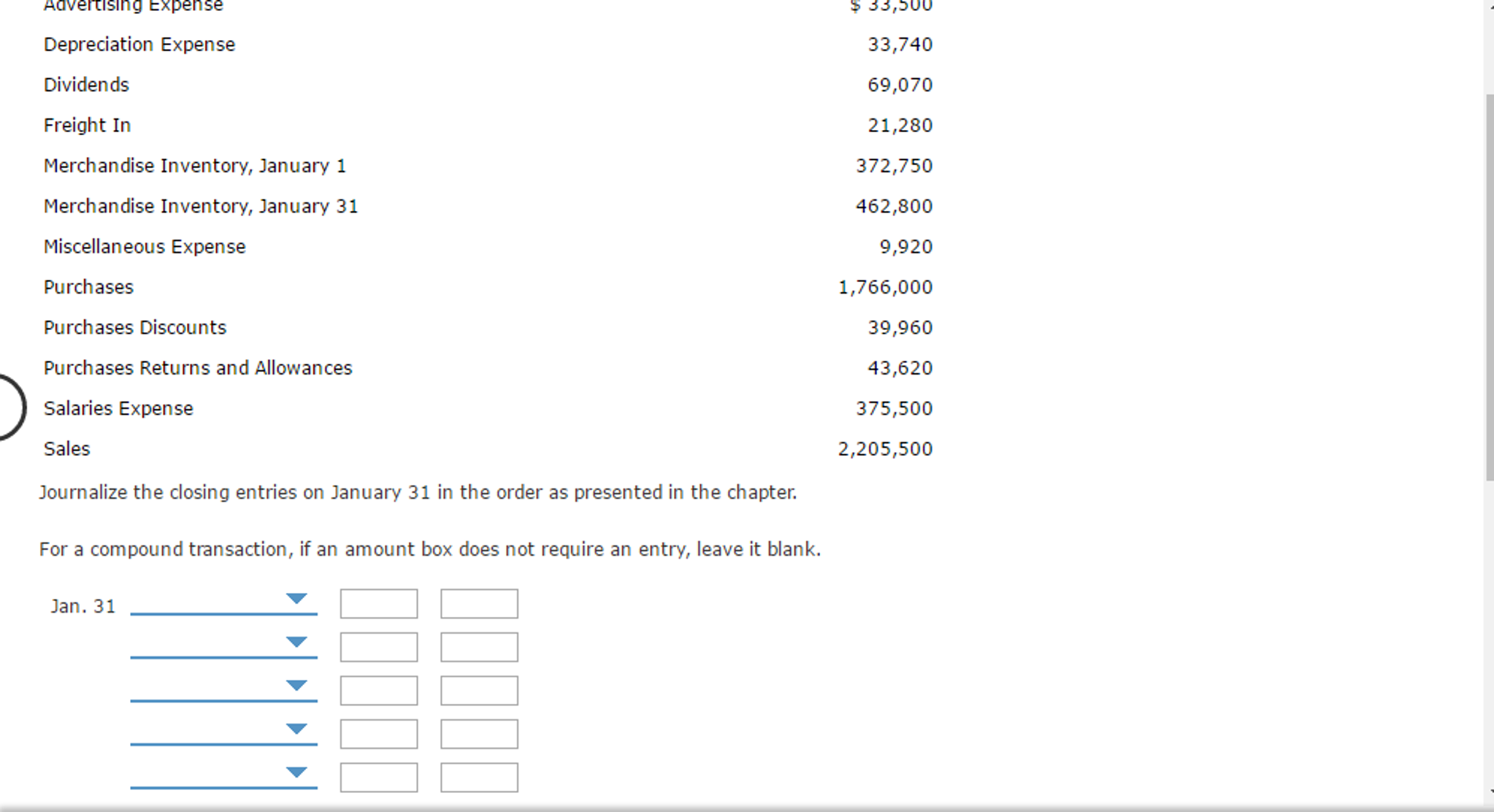

You can also view real-time records of your earnings and expenses through the general ledger. We’ll need to find the total cost of goods available during the accounting period and then calculate the cost of goods sold. Overall, the periodic inventory system can be a practical choice for businesses looking for a simpler, more cost-effective way to manage inventory without the need for real-time tracking. At the end of the accounting period, the business conducts a physical count and calculates the ending inventory. A periodic inventory system is an approach businesses can use to evaluate their merchandise inventory and the cost of goods sold. At the end of the accounting period, you need to determine your firm’s actual ending inventory and “cost of goods sold.” At first, his $100 will be shifted from Purchase Account to Inventory Account.

Financial and Managerial Accounting

To determine the value of Cost of Goods Sold, the business will have to look at the beginning inventory balance, purchases, purchase returns and allowances, discounts, and the ending inventory balance. These journal entries are examples of how you’ll record purchases and the cost of sales at the end of the accounting period if you’re using a periodic inventory system. When paying for inventory purchased on credit, we will decrease what we owe to the seller (accounts payable) and cash. If we take a discount for paying early, we record this discount in the purchase discount account under the periodic inventory method. Let’s say you are running a retail business, in which your firm must purchase inventory almost every day to run your day-to-day business.

Record inventory sales by crediting the accounts receivable account and crediting the sales account. Periodic inventory is the system in which the company does not track individual item movement but only performs physical counts at the month-end. The business only knows the inventory quantity at the beginning and month-end, but they will not know the exact amount in the middle of the month. A periodic inventory system requires less bookkeeping, as there is no need to have separate accounting for raw materials, work in progress, and finished inventory.

- So, every time a product is purchased or sold, the perpetual system uses a barcode scanner to update the inventory count, and recalculate the corresponding cost of goods sold.

- The example below shows the journal entries necessary to record inventories under the periodic system.

- The transaction will record inventory based on the month-end physical count.

- For this reason, buyers record purchase returns and allowances in a separate Purchase Returns and Allowances account.

- This journal shows your company’s debits and credits in a simple column form, organised by date.

The periodic Inventory System method might not be suited for large enterprises due to the high amount of inventory transactions. This is because large organisations must continually track the number of items in their inventory to make essential purchase choices. Companies that lack the resources or do not want to spend a lot of money on implementing a more intricate inventory accounting system are also advised to use the system.

The periodic inventory journal entry is used to record the adjustment to the inventory records and to update the cost of goods sold. The journal entry is also used to update the balance sheet for the cost of goods that were sold during the period. Furthermore, as the journal entries show, inventory purchases are not debited to the merchandise inventory account. There are two systems that we can use to manage the inventory, periodic and perpetual. The periodic inventory system will record the purchase inventory into the purchase account.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click what is the liability to equity ratio of chester on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.